In the beginning, back in 2009, it seemed simple.

For Anthem Inc. (then known as WellPoint Inc.), selling its pharmacy-benefits-management division, called NextRx, for a whopping $4.7 billion to Express Scripts would provide much-needed cash to buy back stock, pay taxes, pay down debt and have enough left over for future acquisitions.

For Express Scripts, the deal would instantly make it the second-largest pharmacy-benefits manager in the United States, based on prescriptions filled, and position it to become the industry’s largest player a few years later.

The centerpiece of the deal was a 10-year commitment to work together. Express Scripts would become the exclusive provider of pharmacy-benefits services to WellPoint, including network management, claims processing and specialty-pharmaceuticals management.

WellPoint retained control of medical policy, formulary and integrated disease management aspects of its pharmacy benefits.

Executives on both sides praised the deal as they rolled it out. The move, they said, would allow employers to have their medical and drug costs managed in an integrated fashion.

“Importantly, through this strategic alliance with Express Scripts, we will enhance the health care value we bring to our members,” Angela Braly, then CEO of WellPoint, said. “This alliance will create an organization with greater resources and capabilities, which will provide members with more cost-effective solutions as well as access to state-of-the-art [pharmacy management] services.”

George Paz, then CEO of Express Scripts, said the deal would allow both companies to blossom. In an interview with the New York Times, he called WellPoint “a fast-growing, acquisitive company.”

“We see their growth as part of our growth,” he said.

Turn of events

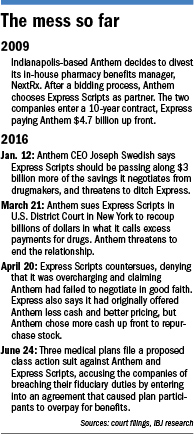

But Braly resigned under pressure from shareholders in 2012. Her successor, Joseph Swedish, had different thoughts about how the deal was playing out.

This January, he said Express Scripts should be passing along billions of dollars in savings it negotiated from drugmakers. He threatened to ditch Express Scripts as a partner, even though the alliance runs through 2019.

“We are entitled to improved pharmaceutical pricing that equates to an annual value capture of more than $3 billion,” Swedish said at a health care conference. “To be clear, this is the amount by which we would be overpaying for pharmaceuticals on an annual basis.”

Much of those savings would be passed on to clients, he said.

Two months later, unable to reach an agreement, Anthem sued Scripts for $15 billion, alleging the company violated its contract through excessive charges. Express Scripts turned the tables a month later, filing a countersuit and denying Anthem’s charges.

As part of its defense, Express Scripts said it originally offered Anthem two options while negotiating to buy NextRx.

The first was to offer a smaller upfront payment, which would be made up with lower drug prices over the 10 years. The other was for a higher upfront payment, which would include higher drug prices.

“And Anthem chose, in essence, Door Number Two,” Michael Carlinsky, attorney for Express Scripts, told a New York federal judge last month, according to a newly filed court transcript. “It took the deal to accept up-front $4.675 billion as opposed to, I think, Door Number One was roughly $500 million, just so the court can appreciate the difference.”

According to court filings, the two sides had signed an agreement that Anthem or a consultant would conduct a market analysis every three years to ensure that it was receiving competitive drug prices.

“In the event Anthem determines that such pricing terms are not competitive, Anthem shall have the ability to propose renegotiated pricing terms to Express Scripts,” the agreement said.

-------------------------

Tyrone's comment: Do you use reference-based pricing as a strategy to determine fair pharmaceutical pricing? If so, is the reference source based upon market price (acquisition cost) or contract agreement? The latter addresses only billing errors while the former discloses the full extent of overpayments, if any.

-------------------------

In return, Express Scripts—which has two central Indiana fulfillment centers with a total of 1,300 employees—agreed to “negotiate in good faith over the proposed new pricing terms.”

It’s unclear how often the two sides would renegotiate prices. Those details were redacted in court filings.

But the dispute now focuses on whether Express Scripts is charging Anthem higher than the market prices for drugs, and if so, what Express Scripts is obligated to do in return.

Read more >>